Energy Deals Newsbreak Latam | Ed. #43

Big-ticket M&A deals have yet to land in the region, but strategic moves keep stacking up like chess pieces poised for checkmate.

Solar, wind and lithium continue to draw bets, with Argentina, Brazil and Mexico redefining their positions on the regional board. While some markets race ahead in the energy transition, others struggle to keep pace amid a challenging macro backdrop.

This edition is packed with standout stories, an up-to-the-minute view of the LatAm landscape and headline-grabbing deals.

Here are a few highlights from the fortnight:

Diamante Energia will acquire 100% of the 720 MW Pecém coal plant in Ceará for BRL 1 bn, buying out EDP and Mercurio Asset. The package includes licensed gas-fired projects that Diamante intends to bid with in upcoming capacity auctions

Luz del Sur has agreed to buy 100% of Energía Renovable del Sur, owner of the 135.7 MW San Juan de Marcona wind farm in Ica, for up to USDm 253 plus customary cash adjustments

CADE has cleared Vestas’ takeover of 10 greenfield wind projects in Pedra Preta and Jandaíra, Rio Grande do Norte, from Eneva; the price tag was not disclosed

Good reading!

How AI agents are reshaping M&A from sourcing to diligence: Examples and case studies

Artificial intelligence (AI) agents have huge potential to make deal processes faster and more efficient. But how do you separate the tangible use cases from the marketing hype?

On July 16, we're hosting a webinar in association with Ideals and Comparables.AI to look at how dealmakers are using AI to gain a competitive advantage and how these use cases will develop in 2026.

M&A Renewables

CADE cleared the sale of Raízen’s Leme plant for BRLm 425; the deal was announced in May

Vestas acquired 10 greenfield wind projects from Eneva in Rio Grande do Norte; value undisclosed.

Luz del Sur signed an agreement to buy the San Juan de Marcona wind farm

M&A Energy

Oil-and-lubricants reseller Repelub was acquired by Risel Combustíveis (Grupo Vibra) for BRLm 75

LipiAndes, through its subsidiary Limagas Natural, acquired 70% of the Ecuadorian company Sycar

Edenor announced the purchase of shares in a lithium mining company in Catamarca

Investment & Financing Renewables

Raízen returned to the bond market with a USDm 750 issue to extend its debt profile

GreenYellow and Davivienda close EURm 7.8 financing for 10.9 MWp solar plant in Colombia

EPM to invest COP 1 bn to develop hydroelectric power generation projects

CAF grants EURm 25 to Cox to promote energy transition projects in Latin America and the Caribbean

Investment & Financing Energy

Calidda to receive USDm 500 loan from CAF to expand its natural gas network in Lima and Callao

Edesur obtains syndicated loan to finance investments in physical assets and capital goods

Exar's mining project in Argentina receives USDm 100 loan from Chinese bank

Balam units secure up to USDm 15 for solar projects in Mexico

Announced/Not confirmed

Market whispers

Brazil

Eleven years after CADE ruled that CSN’s stake in Usiminas harms competition, the watchdog has lost patience and given CSN 60 days to present a divestment plan

Low returns are pushing companies to abandon renewable-generation projects in Brazil

Engie’s CFO, Eduardo Takamori Guiyotoku, resigned to take the same post at a subsidiary

LATAM

Petroperu seeks partner for Amazon block, is in talks with five companies

Chile's Colbún enters the bidding for Acciona's wind power plants for EURm 600

Transmission delays jeopardize growth of photovoltaic projects in Colombia

Asoenergía asked Ecopetrol for clear accounts of its controlled gas production

Failure to take advantage of renewable energy costs Latin America nearly USD 7 bn each year

Superservicios considers new measures against companies that bought gas imported into Colombia

Another ruling orders Argentina to hand over YPF shares sued by Bainbridge fund

Former YPF president rejects US judge's ruling against Argentina

Pemex, YPF and EPM among Latin America's most liquidity-risky companies, according to Moody's

Argentina normalizes gas transportation and lifts restrictions on industries after cold snap crisis

Ecopetrol and Dian in dispute over VAT payment on fuel imports

Ecuador acknowledges damage to oil exports due to suspension of two oil pipelines

From cash crunch to power punch: Who wins Latin America’s Q3 showdown?

Q3 is just beginning, and for many dealmakers this quarter could prove decisive. July opens on the heels of a pull-back in both M&A and venture-capital activity. In a world strained by geopolitical tension and mounting economic pressure, what looks like a difficult scenario may actually hide opportunity. Yet, common challenges converge.

Anyone steering deals through the Q3 2025 must track several trends, starting with scarcer venture capital, stretched valuations, and the return of old ghosts haunting the region’s main markets.

Yet before measuring the fallout in Energy, it helps to scan a few broader indicators.

Venture capital is turning sharply selective

Founders should brace for longer fundraising cycles and less favorable terms (especially beyond Series B) making strong operating metrics and clear exit paths essential. What feels challenging for entrepreneurs is largely defensive positioning by investors.

PitchBook’s latest data (cited by Bloomberg) show just 335 transactions worth USD 2.9 bn in H1 2025, which leaves a somewhat discouraging projection. At the current pace, the year would close with the fewest deals since 2016, before the venture capital boom in the region.

Round dynamics point to an investor-friendly market

To understand this shift, look at deal anatomy: the median time between rounds has lengthened since the 2021 peak, while valuation step-ups are receding (especially in late-stage and venture-growth deals) signaling sharper price discipline.

PitchBook’s VC Dealmaking Indicator shows that, as speed and step-ups fall, three protective clauses are on the rise:

Cumulative dividends: unpaid dividends pile up until redemption or liquidation.

Liquidation participation: investors recoup their capital (sometimes a multiple) before other shareholders at exit.

Higher equity stakes: bigger slices today cushion future dilution.

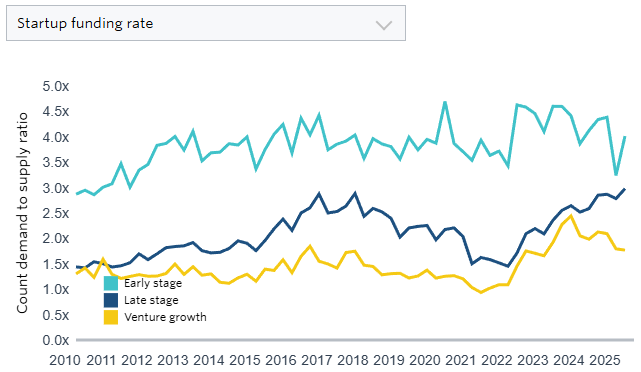

The report debuts the startup funding rate, which compares the number of startups hunting capital with the actual volume of deals:

Early stage: the long-term average is 3.8×, only one in four startups lands a round.

Later stages: the “capital traffic jam” worsens. Fewer deals, slower step-ups, and shrinking late-stage checks show investors seeking early-stage safety while IPO exits stay scarce. Mature startups feel the squeeze most when public-market windows close.

Together, these conditions reflect a market where investors wield greater bargaining power and seek to buffer risk amid low liquidity or more conservative valuations.

Challenges and opportunities in Latin America’s energy arena

M&A and venture-capital data signal a more conservative, harder-to-scale global landscape. As risk capital itself tightens, the energy sector feels the squeeze, forcing dealmakers to weigh every next move with extra care. Even segments once viewed as safe wildcards (like solar) now carry an intimidating edge, especially in Brazil.

At first glance, the market still shows its opportunities. Forbes forecasts 13% solar-capacity growth in Latin America by end-2025, propelled by Chinese tech adoption and investor appetite. Notable standouts include:

Chile: now generates 20%+ of its electricity from solar.

Brazil: the region’s heavyweight, expanding solar capacity at 15%+ a year.

Mexico: has reached 3.33 GW of distributed solar, up 700 MW in 2025 alone.

A new GlobeNewswire report, “Latin America and Caribbean Energy Transition 2025”, also highlights the growing role of solar energy in the region and positions wind as the second most relevant source within the energy matrix, consolidating its place in the transition to a more diversified and resilient model.

Brazil drinks deepest from these opportunities, yet not without strain.

Brazil: dominant but constrained

Brazil remains at the top of the region. It is the dominant market in terms of energy transaction volume; however, The Rio Times records a 1% dip in deal count and a 25% slide in capital raised. Add on this the presence of an old nemesis, the curtailment:

Renewable curtailment could jump 300% by 2035, shaving off 8% of national output and up to 11% in the Northeast.

Even with 76 GW of new capacity planned, transmission bottlenecks linger; marquee lines like the Graça Aranha–Silvânia bipole won’t fully stem rising revenue loss and shelved projects.

Thus Brazil’s solar boom risks being overshadowed by structural snags. And, actually, this is already pushing companies to abandon renewable-generation projects in Brazil. Until 2035, the country's power grid is expected to not support renewable expansion.

In this scenario, the most attractive assets are those with resilient contracts and minimal curtailment exposure.

Fiscal strain, regulatory fatigue (plus hungry sharks)

Brazil also faces fiscal pressure and regulatory fatigue. While its main market wrestles with hurdles, predators smell blood.

IProfessionals reveal that Argentina has become the cycle’s big shark: 19% more deals and 105% more capital, led by energy acquisitions. Vaca Muerta races toward record shale output, potentially doubling by 2030 if pipelines and ports unlock.

Meanwhile, lithium stays hot even as overall M&A cools. El Economista notes transactions linked to minerals such as lithium remain stable in ticket size.

It’s not Brazil: other markets are heating up. Mexico eyes Sonora as a lithium hub, though questions remain; can it stand up the needed infrastructure and rules before the global window closes?

The key question is whether it will arrive in time:

Will Mexico be able to develop the necessary infrastructure and regulatory frameworks before the global lithium window closes?

Will Argentina consolidate as a leader or is it just for a moment?

Will Brazil know how to adapt to its new reality and maintain leadership amid regulatory fatigue and infraestructure challenges?

Who will best seize this transitional phase, where capital now demands sharper strategic clarity and iron discipline?

General Landscape

Brazil

Renewables curtailment in Brazil could rise by up to 300% by 2035

Brazil's silent revolution in oil: investment overflow takes it to the producers' olympus

BYD inaugurates its new factory in Brazil with the production of its first 100% electric vehicle

Petrobras to invest USD 5.5 bn in Rio de Janeiro to boost refining and petrochemicals

Brazilian power grid will not support expected renewable expansion until 2035

LATAM

Chile's Ministry of Energy plans to process 12 regulations in the coming months

In Chile, Pacific Hydro bids for the maintenance of the Desierto de Atacama photovoltaic farm

Actis-backed Orygen to soon start building 94.2-MW solar farm in Peru

Jinko ESS, Metlen ink 3-GWh energy storage deal for Europe, Chile

GameChange Solar places 715 MWp of solar trackers for eight new projects in Latin America

Chile's Electricity Coordinator proposed seven new transmission works in the system planning

Ecuador receives USDm 77 IDB financing for private sector renewable energy projects

Argentina facing a new renewable cycle: legal keys, bankability and transmission challenges

Colombia's largest solar park to be built in Cesar department

BASF agrees PPA with Genneia for the supply of renewable energy for its plants in Argentina

Report projects demand for up to 27.000 new workers in Chile's energy value chain

In Argentina, photovoltaic power is close to 2 GW installed capacity

Solar energy to grow 13% in Latin America by 2025 with Chinese technology

Ecopetrol announces the commercial character of Lorito, Colombia's seventh largest field

Peru brings solar energy to more than 55.000 rural homes in 20 regions

Colombia adjusts conditions for the development of offshore wind projects

Argentina facing the energy transition: certainties, challenges and the bet on trust

Colombian hydrocarbon companies closed 2024 with lower revenues and earnings

Solar energy to grow 13% in Latin America by the end of 2025

Argentina's Pampa Energía applies for RIGI membership for USDm 426 investment project

Buenos Aires could cover 81 % of its total electricity demand with photovoltaics and BESS

Tenaris starts construction of its second wind farm in Argentina

Hydrogen exports from Latin America will exceed USD 13 bn by 2050

Tenaris breaks ground on 94.5-MW wind farm project in Argentina

Cordoba prepares a bidding process with hybrid tariff for solar and bioenergy projects

After the boom, the slowdown: fracking fell sharply in Vaca Muerta

Argentina's energy demand plummets: -10.4% in May and three months in the red

Argentina, the new magnet for lithium investment? PwC warns: "It's now or never"

Record in Vaca Muerta: it already produces almost 6 out of every 10 barrels in the country

TotalEnergies an oil company builds the world's southernmost wind farm in Argentina

Onshore wind power growth in S America to slow by 2034, WoodMac says

The Chilean Senate Committee rejected that the PMGD finance electricity subsidies

Oil, uranium and renewables: Chubut seeks to return to the big leagues

Argentina, Chile and Ecuador lead green investment ranking in Latin America

The presence of free natural hydrogen in the subsoil of Colombia was discovered

Copec Voltex inaugurates its first RED-standard electro-terminal in southern Chile

Mercosur countries reaffirm their regional commitment to natural gas

Paraguay and Argentina sign agreement to build gas pipeline to transport energy from Argentina