Energy Deals Newsbreak Latam | Ed. #38

Hello,

Europe’s blackout has sent ripples of unease worldwide, especially in markets whose energy chains mirror Spain’s, today’s epicentre of supply cuts. In Brazil, regulators are huddling just as Q1 figures start to land, and fears of curtailment (and the multi-billion-real liabilities it already carries) are rising fast. In this tug-of-war, renewables take most of the punches.

Battery energy-storage systems (BESS) are sweeping Latin America, and some hope to turn storage into a national art form—much as Brazil once did with football. Capital is pouring into battery projects across the region, fuelling Chile’s red-hot renewables boom.

Yet that is only part of the story: the past fortnight has also seen a flurry of strategic manoeuvres, including:

Spain’s Acciona is acquiring and will build the 330 km, 220 kV Machupicchu–Quencoro–Onocora–Tintaya line for about USDm 270, adding two new and expanding three existing substations;

Vista Energy will buy Petronas’s 50% share in the La Amarga Chica shale block in Vaca Muerta for up to USD 1.5 bn (USDm 900 cash now, USDm 300 Santander loan, plus USDm 300 deferred to 2029-30 and a 7 % Vista equity stake);

Glenfarne Asset Company will pay USDm 815 (including assumed debt) to acquire from Metlen 588 MW of operating PV plants and 1,610 MWh of battery projects now under construction across multiple nodes in Chile’s SEN.

Good reading!

M&A Renewables

Celsia acquired a portfolio of solar and wind energy projects and is approaching its goal

Glenfarne acquires Metlen's portfolio of solar and energy storage assets in Chile for USDm 815

M&A Energy

Vista Energy acquires 50% of Petronas' Vaca Muerta oil field for EUR 1.32 bn

Celsia acquired a portfolio of solar and wind energy projects and is approaching its goal

REN acquires the electricity transmission company TENSA in Chile for USDm 71.4

Acciona acquired the Machupicchu–Quencoro–Onocora–Tintaya transmission line project in Cusco

Investment & Financing Renewables

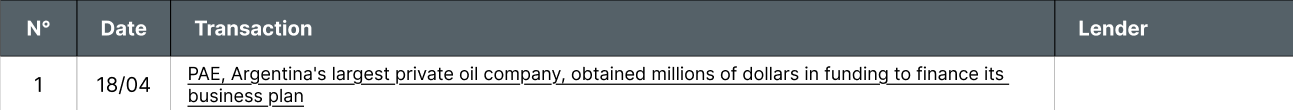

Investment & Financing Energy

Announced/Not confirmed

Shell will sell its assets in Colombia and will no longer be Ecopetrol's gas partner

Acciona is putting two 321 MW wind farms up for sale in the Mexican state of Tamaulipas

Fundraising

Market whispers

Brazil

LATAM

A fine is being imposed on Canadian oil companies operating in Casanare, Colombia

With the sale of Shell's stake, six oil companies have divested from Colombia

Spain’s blackout makes the spectre of curtailment even scarier (a problem Brazil seems ill-equipped to confront)

Everything looks fine, until it doesn’t. The recent, wide-ranging power outage that swept across Europe, hitting the Iberian Peninsula hardest, adds yet another piece to the puzzle of challenges the energy industry must tackle over the next decade. Supply cuts, paired with infrastructure bottlenecks, financing gaps, shifting demand patterns and volatile prices, are not confined to Europe; they are also haunting Latin America’s largest market. And the past fortnight has produced developments that cast Brazil’s predicament in an even starker light.

In Brazil, the spotlight remains firmly on renewables. As we noted in Energy Deals Newsbreak, the segment now risks paying for its own success. Despite our seemingly pessimistic opening, renewables continue to generate deal flow. Solar, for instance, defied the global slowdown and logged a 25% jump in M&A volume in Q1 25. Greener’s latest report shows that self-generation led the charge, responsible for five of the seven utility-scale PV transactions and mobilising at least ten plants.

But the wave of investment, especially in generation capacity during the 2010s, is starting to reveal its structural cracks. In northern Minas Gerais alone, Brazil’s system operator (ONS) has already curtailed 21.2% of generated power. The issue gained momentum after a surge of solar output from 3.6 GW in January 2024 to more than 7 GW at the start of 2025.

Following the crisis, ONS tightened security criteria and slashed 3 GW of real-time renewable injection; investors now call curtailment the “number-one brake” on new projects. This is hardly the first recent case of curtailment spawning multi-billion-real regulatory liabilities and ratcheting up risk premiums. A lack of reliable data and the complexity of balancing production triggered a sweeping blackout that wiped out 23% of Brazil’s grid in 2023.

The fallout comes in fines as well: on 22 April the regulator confirmed fines totalling BRLm 150 for affected operators.

Greener attributes 40.6% of cuts to oversupply at weekends, 36.9% to reliability concerns and 22.6% to outright unavailability.

Curtailment pain spreads across technologies

Brazil’s wind sector is suffering its worst crisis in twenty years, according to ABEEólica. Oversupply, compounded by a lack of new transmission lines, has led to repeated output cuts and stalled turbine orders—no small blow to an industry that is 80 % localised. ABEEólica points to three root causes:

High curtailment;

No grid connection for future green-hydrogen and data-centre projects;

A PPA drought that sent wind investment plunging from BRLm 5.6 in 2023 to BRLm 1.8 in 2024.

BloombergNEF expects the sector’s first response to be a slowdown in capex: annual capacity additions should shrink from 2.7 GW (2025) to 1.4 GW (2027). Yet solving these challenges is not just risk-mitigation it is hard ROI. ONS data show 1.3 TWh of renewable power was wasted in 2023, enough to run a capital the size of Fortaleza for more than a month.

Who foots the bill? Hydros push back

All roads lead to the same chokepoint: curtailment has become the critical bottleneck for renewables growth. The debate, however, is anything but harmonious. Hydro operators and central generators are sparring over who should pay for the cuts, an argument Brazil’s regulator (ANEEL) must settle in the months ahead. Last week, the agency heard market proposals to tweak curtailment methodology to favour hydropower over non-dispatchable sources such as wind and solar (a move, sector associations claim, that could shave more than BRLm 500 from consumer bills).

Battles rage on other fronts as well. While ONS rolls out system-enhancement plans and the Energy Ministry promises compensation rules, investors are lobbying for storage models and capacity-market auctions that reward flexibility. Talk of opening the free-power market to smaller consumers by 2027 is back (though we have heard that promise before).

Elsewhere in Latin America, tempers have cooled and solutions are advancing. Chile, currently the region’s hottest renewables market, has just hit 954 MW of battery storage, halfway to its 2 GW target for 2030. Storage is not only easing peak-demand headaches; it is also turning into a dealmaker’s playground. This fortnight alone:

Glenfarne bought Metlen’s storage portfolio for a hefty USDm 815;

Across the Andes, Argentina saw 360energy commission its second battery bank at the Cañada Honda PV Park.

Investing in BESS is “virtually mandatory”

Experts at the “Storage: Opportunities in LatAm” webinar underlined that, amid intermittent solar and wind oversupply that triggers curtailment and erodes revenues, battery energy-storage systems (BESS) are now “virtually mandatory”. Beyond preventing spill-over and providing millisecond response to critical demand, BESS enables peak-shaving, unlocks new revenue streams for power and ancillary services, reduces future OPEX and already delivers savings of 20-25 USD/MWh in off-grid applications and under 50 USD/MWh for large industrial projects, thanks to a ~20 % fall in battery prices.

This drive to diversify returns and fortify the grid is rapidly positioning BESS as the strategic answer to unlock investment and break the curtailment bottleneck across Latin America—yet Brazil still appears to be learning that lesson.

General Landscape

Brazil

LATAM

Bolivia announces a new contract to exploit lithium, this time with a Russian company

Ecopetrol signs an agreement with AES Colombia to build the Jemeiwaa Ka'l wind farm cluster

YPF will develop Argentina's largest LNG project in partnership with Italian giant Eni

Longi and OCADE sign an agreement to promote photovoltaic module recycling in Colombia

360energy launches the second battery bank at the Cañada Honda Photovoltaic Park in Argentina

Grenergy seeks offtakers for 1.7 TWh/y of clean power in Chile

Liquidity, clear rules, and attractive PPAs: Guatemala attracts renewable energy investors

Grenergy launches a reverse auction in Chile to sell 1.7 TWh of photovoltaic energy

"There are no raw materials for the future": CEO of Centelsa by Nexans

The appetite of independent customers for solar energy is growing in Peru

Andes Solar connects the 13 MWp Villacurí solar plant, its first in Peru

Chile has 954 MW of energy storage systems in operation, 48% of the 2 GW target for 2030

In Chile, Codelco has awarded 1.5 TWh of renewable energy annually for the period 2026-2040

Electric vehicles set a record in Peru: sales grew 56% in March and 37.6% in the first quarter

Colombia on the verge of surpassing 2 GW of operational photovoltaic capacity

Genneia expands its renewable capacity with an ambitious pipeline in Argentina

Chilean regulator approves lithium deal between Codelco and SQM

Uruguay will close out 2024 with 99% of its electricity coming from renewable sources

Peru aligns with the IEA to accelerate the energy transition to renewables

Mexico

Syngenta is supplied with 100% renewable energy thanks to an agreement with Genneia

JA Solar identifies a new window for photovoltaic projects in Mexico

Sungrow projects a revival of the Mexican market by the end of 2025

Vestas and Naturgy agree to operate the Bií Hioxo wind farm in Oaxaca

Discover our other publications

If you want to stay updated on global M&A/PE news, you can also subscribe to the M&A Community Latam, M&A Community Brasil, M&A Teaser Italy, and M&A Teaser Iberia, in addition to our Energy Deals Newsbreak Iberia with the most relevant information on the energy sector in Iberia.