Energy Deals Newsbreak Latam | Ed. #37

Hello,

The past two weeks were marked by billion-dollar deals across Latin America's energy sector. Checks exceeding USD 1 bn have become increasingly common, particularly in Brazil, the region’s largest market. While dealmakers continue to seize opportunities amid global economic pressures, regulatory challenges are beginning to surface.

Brazil’s long-anticipated energy reform, seen as a key enabler for the already heating M&A landscape in 2025, is now facing political friction. Although some expect the proposal to reach Congress this April, internal disagreements within the government could delay or derail the process.

In this edition, dive deeper into the unfolding political gridlock—and explore the most relevant energy deals of the fortnight, including:

Equatorial sold its transmission unit in a deal valued at BRL 9.4 bn

Geopark announced the sale of the Llanos 32 and Manatí oil and gas fields

Good reading!

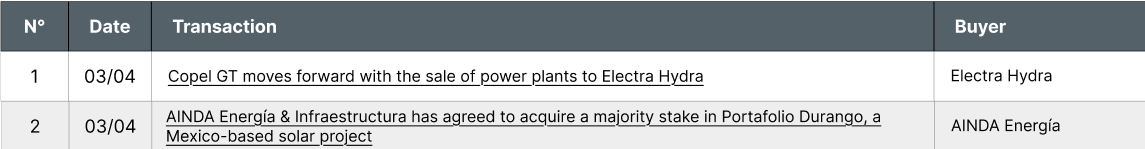

M&A Renewables

M&A Energy

Equatorial sold its transmission unit in a deal valued at BRL 9.4 billion

Geopark announced the sale of the Llanos 32 and Manatí oil and gas fields

Investment & Financing Renewables

Thopen, a Pontal Energy company, raises BRLm 90 to invest in solar power plants

Erco Energia secures USDm 20 from a Norwegian fund to support its expansion in Latin America

Investment & Financing Energy

Announced/Not confirmed

EDP expects to renew its concession in Espírito Santo by May

Petroperú will hold a public tender to operate Lot 192 with a new partner

Sempra puts assets in Mexico up for sale to meet AI energy demand

Ecopetrol is considering buying SierraCol Energy to increase its reserves

The investment to advance hydrogen projects in Colombia is estimated to be USD 45 bn

SIC approval: Ecopetrol's deal with Enel for the acquisition of Windpeshi is progressing

The Mexican government presents a historic investment to ensure the country's energy sovereignty

International

Fundraising

GDS Subholding issues its first debenture and raises BRLm 410 to expand distributed generation

Solar Americas Capital raises BRLm 143 from BNDES to invest in solar energy projects across Brazil

Evolti and A2censo launched a new crowdfunding campaign to finance a solar farm in the Atlantic

Market whispers

Brazil

ONS has until June to present a study aimed at reducing power generation cuts

Aneel upholds penalty for delays in the construction of the Marlim Azul thermal power plant

LATAM

Uncertainty over regulatory changes for renewable energy in El Salvador

Andeg warns of debts of more than COP 2 bn from Air-e to electricity market agents

Helicol announced that it will sue Ecopetrol millionaire for compensation

Amid tariffs: YPF CEO says he can compete and develop Vaca Muerta even with a barrel at USD 45

Energy unions reject the Colombian government's accusations against companies in the sector

The SIC fined Gas Technical Home for using the Vanti brand to offer services

Petroecuador transfers USDm 1.4 to compensate those affected by the oil spill

Energy reform moves forward in Brazil, but the landscape remains fragile

M&A activity in Brazil’s energy sector is expected to reach BRL 120 bn in 2025, according to estimates by Swiss bank UBS BB. Opportunities in Latin America’s largest power market are largely underpinned by growing demand: electricity consumption rose 10% between 2019 and 2023, according to the government-run Energy Research Company (EPE). And while 2024 data is still being consolidated, the EPE projects this upward trend will continue, with average annual growth of 2.1% in electricity consumption through 2034.

Despite the positive outlook for energy-related M&A, significant hurdles remain, especially in renewables. Recent data from asset manager Equus Capital shows that between July and October 2024, more than 22,000 GWh of wind and solar generation went unused. In practical terms, this curtailment affected the equivalent of 63% of all thermal generation in the same period.

Overcoming such bottlenecks requires not only capital, but also regulatory reform (a growing demand among Brazilian energy executives). And momentum seems to be building: a reform package could hit Congress as early as April.

Industry pushes for reform, but political hurdles persist

This month, Brazil’s Minister of Mines and Energy, Alexandre Silveira, voiced his support for submitting the electricity reform bill to Congress in April. However, between the ambition to boost competitiveness in the sector and the political risks of introducing structural change so close to the 2026 general elections, the proposal remains surrounded by uncertainty.

The government’s goal is to pass a “foundational” reform to fix longstanding distortions created by years of legislative patchwork—commonly referred to as jabutis, or legislative “pork.” But herein lies the challenge. Silveira said he will submit the proposal to the Chief of Staff for final internal approval. Yet, according to sources within the executive branch, there’s growing concern that pushing a bill of this magnitude through Congress could prove costly and politically risky.

One workaround being floated is to “break up” the reform package into smaller pieces, focusing on less controversial measures such as full liberalization of the energy market, regulatory modernization, and improved concession rules—rather than betting on a single, all-encompassing bill that could stall.

A likely starting point for the reform is the expansion of eligibility for social electricity tariffs. Minister Silveira has proposed free power for households consuming up to 80 kWh per month and the elimination of surcharges such as the Energy Development Account (CDE) for low-income families registered in Brazil’s federal social program. This could benefit up to 60 million people.

Still, the financing model for such expansion is a source of tension. The Ministry of Finance is wary of raising subsidies through the CDE or other primary sources, fearing this could either drive up electricity bills or force new taxes on the sector. While social assistance is essential, such measures could backfire by scaring off investors, defeating the reform’s very purpose.

This tension became evident when Finance Minister Fernando Haddad, immediately after Silveira’s announcement, publicly stated he was unaware of any proposal expanding the Social Tariff and questioned the feasibility of such a subsidy. The final word may fall to President Lula himself, as the government also sees the move as a potential populist lever to boost its approval ratings.

Reform seems inevitable, but the topic remains contentious

Few deny the urgent need to modernize Brazil’s electricity sector. The country is wasting clean energy on one end and underinvesting in infrastructure on the other, all while tariffs remain under constant pressure.

Although the national regulator projects a 3.5% average tariff increase in 2025 (below inflation levels) without a long-term fix, the sector risks falling deeper into a cycle of cross-subsidies, transmission bottlenecks, and complex pricing structures that hurt both consumers and businesses.

This sense of urgency is reflected in market expectations: dealmakers expect that tariff prices could rise by 10% (way beyond Aneel’s projections), and without tax relief, this growth not only burdens consumers but also undermines business competitiveness.

A broad reform package must be the result of active engagement with all relevant stakeholders. A rushed approval risks producing more legislative “patches” rather than real solutions.

Whether the government moves forward with a comprehensive bill or opts for the more cautious, piecemeal approach advocated by parts of Congress, one thing is clear: the debate must not be overshadowed by electoral convenience. The energy reform is more than a behind-the-scenes political maneuver; it directly impacts Brazil’s economic competitiveness and regional growth prospects, especially in this sensitive moment of rising energy costs.

General Landscape

Brazil

Neoenergia reports a 3.6% increase in injected energy volume in Q1

Sungrow to supply inverters for Élis Energia’s solar PV plant in Mato Grosso

Companies with renewables in their portfolio are valued 25% higher, says PwC

Brazil’s Supreme Court inaugurates a solar power plant at its headquarters

Distributed micro and mini generation surpasses 2 GW in Q1 2025

Fictor and WTT open the second solar plant of the Goiás Cluster

Final stretch of energy concession renewals could unlock mergers and acquisitions, analysts say

Delta Energia targets BRL 1 bn investment in gas and biofuel thermal plants

Renova announces capital increase and confirmation of credits by VC Energia II

For Fitch, agreement with the Union is positive for Eletrobras

Government creates working group to minimize curtailment in solar and wind power plants

Minister defends use of public resources to reduce electricity bills

Government publishes decree to avoid 6% increase in tariffs in 2025

Climate crisis reduces ethanol supply, but producers expect demand to expand

LATAM

Further increases in gas prices in Colombia are expected in the coming years due to imports

Argentina inaugurates gas exports to Brazil via Bolivia in a TotalEnergies agreement with Matrix

Ecopetrol and Latam Airlines join forces for air energy transition in Colombia

Vaca Muerta fracking is unstoppable: the numbers are shocking

Argentina rose 0.5% in February, reaching 12,911.7 GWh, with a new power record of 30,257 MW.

Zelestra and Celepsa sign a PPA for a 238 MWdc solar project in Peru

Three health energy communities have opened in Magdalena, Colombia

Solar panels are being installed in protected natural areas of Argentine Patagonia

European financial support for green hydrogen projects in Chile

Yingli Solar identifies a favorable ecosystem for solar energy projects in Argentina

The SIC approved the transaction that will allow Ecopetrol to acquire Windpeshi

Peru has a portfolio of 14 solar power plant projects with a capacity of 2,447 MW

Chile aims to attract investors and strengthen energy collaboration with China

Daniel Montamant asks: Will 2025 be a good year for Argentina's energy sector?

For the first time in history, Argentine gas reached one of the largest markets in the world

Kallpa Generación has applied for a concession to study the 403 MW Tanaka Wind Farm in Arequipa

New scarcity prices are leading to disinvestment in small hydroelectric plants in Colombia

Uncertainty in the energy sector jeopardizes investments of more than COP 13 bn

Bolivia aims to become a strategic energy supplier to Brazil

Zelestra secures power offtaker for 238-MWp solar project in Peru

Atlas seals 230-MW battery storage PPA with utility Colbun in Chile

Colombia introduces new legal framework for energy communities

Peru will reach 3 GW of installed photovoltaic capacity by 2028

Photovoltaic electricity generation in Latin America and the Caribbean grew by 39.7% in 2024

Colombia opens process to define rules for white hydrogen exploration areas

Mexico

Discover our other publications

If you want to stay updated on global M&A/PE news, you can also subscribe to the M&A Community Latam, M&A Community Brasil, M&A Teaser Italy, and M&A Teaser Iberia, in addition to our Energy Deals Newsbreak Iberia with the most relevant information on the energy sector in Iberia.