Energy Deals Newsbreak LATAM | Ed. #33

Hello, renewables seem to have cooled off a bit more in 2024, while upstream is gaining momentum.

As the M&A landscape in Latin America takes on a more polarized shape, major players took advantage of early February to close some mid-sized-sized deals.

Highlights include:

Cargill surprises, makes billion-dollar bid and announces purchase of 100% of SJC Bioenergia

Ecopetrol concluded the acquisition of 45% of Repsol in Block CPO-09

Now, let’s break down the latest deals and market shifts from the past two weeks.

How did the global M&A landscape look in 2024?

After two years of slowdown, M&A closed out 2024 with renewed momentum. PitchBook’s 2024 Annual Global M&A Report, sponsored by Ideals, highlights how increased liquidity and declining global interest rates fueled dealmaking during this period.

📌 Check out the key sectors that drove the strongest growth

📌 Discover how valuations are shaping up and the opportunities they present

📌 Dive into the rising share of private equity in total transaction value

The study also projects an optimistic outlook for 2025, as markets transition to a more “risk-on” stance following one of the most turbulent periods since the global financial crisis.

Curious how these trends might impact your M&A strategies next year? Download the 2024 Annual Global M&A Report now and gain exclusive insights into the sector’s key trends!

M&A Renewables

French EDF buys hydroelectric plant from Neoenergia for BRL 1.43 bn

Athon buys 23 solar plants from GreenYellow and targets new acquisitions

Neoenergia signs agreement to sell Baixo Iguaçu hydroelectric plant

Cargill surprises, makes billion-dollar bid and announces purchase of 100% of SJC Bioenergia

M&A Energy

Brava sells 11 fields in the Potiguar Basin to Azevedo & Travassos and PVE

Ecopetrol concluded the acquisition of 45% of Repsol in Block CPO-09

Investment & Financing Renewables

Investment & Financing Energy

Announced/Not Confirmed

Enel promises to invest BRL 6.1 bn to improve distribution services in Rio

YPF seeks partners for gas: the tough negotiation to obtain USD 9 bn

Global investors show interest in mining and renewable energies in Peru

Colombia: offshore wind projects in the Government's sights, but details must still be finalized

International

Chile's agreement with the European Union to develop lithium and copper value chains is in force

Aggreko invests in hybrid solutions to drive energy transition in Latin America

Brazil and Japan study financing of energy transition and green economy projects

On a visit to India, Petrobras evaluates auction and closes agreement to export oil

Fundraising

Market whispers

Brazil

Rialma Group, owned by the Caiado family, puts PCHs up for sale

KPS evaluates purchase of diesel thermal plant from Eletrobras

Vale analyzes sale of 70% of Aliança Energia to Global Infrastructure Partners

Aneel confirms transfer of BRLm 600 to Amazonas Energia for easing efficiency criteria

Aneel will seek agreement for the transfer of Amazonas Energia

LATAM

Citi keeps Ecopetrol at high risk for possible sale of fracking business

Chilean electricity company CGE fined for exceeding deadlines for installing renewable projects

President of the GEB said that Ecopetrol has increased gas prices and should be investigated

Strong call for attention from the energy sector to the Colombian Government for investigations

They deny alleged forced intervention to Vanti and other companies in the gas sector in Colombia

Upstream sector activity surges amid renewables slowdown

The transition to renewable energy in Latin America is progressing along asymmetrical paths. In 2024, while nations with low oil dependence (such as Chile, Costa Rica, and Uruguay) achieved significant advancements in renewable energy adoption, even reaching predominantly renewable electricity generation levels, other fossil fuel-rich countries have seen their transition efforts slow down.

This polarization appears to have global roots. In recent weeks, oil companies have been revising their renewable energy strategies. Equinor, for instance, reduced its clean energy project targets for 2030 and abandoned its commitment to invest half of its capital in low-carbon initiatives. This decision, along with Shell’s suspension of new offshore wind projects, stems from supply chain challenges, inflationary pressures, and less ambitious environmental policies, such as those in the U.S.

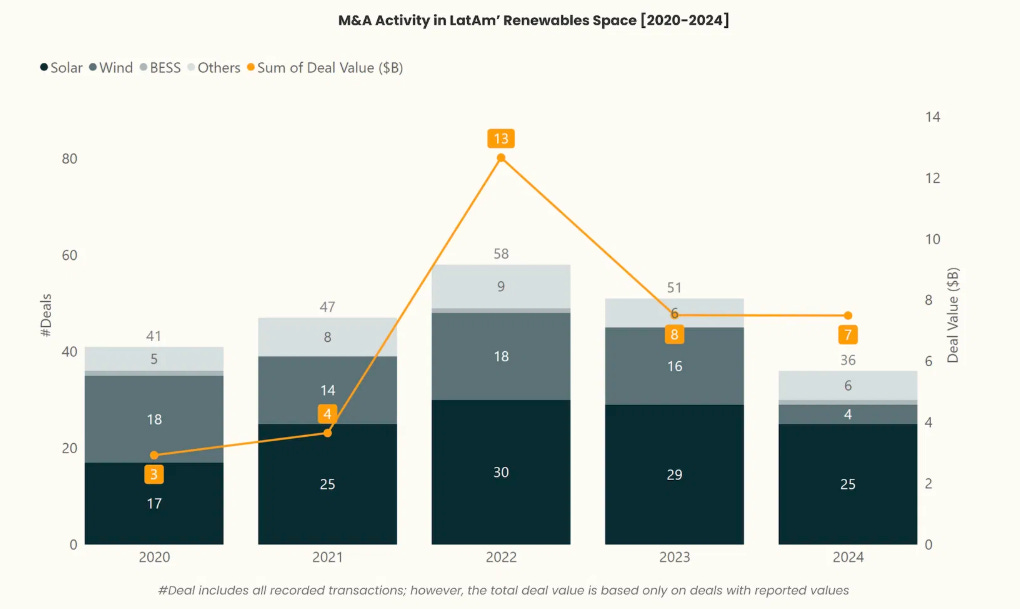

Now, 2024 data reinforces the slowdown in LATAMs M&A activity within the sector over the past year—an issue that is not exclusive to the region. Globally, lower anticipated returns, high interest rates, and other factors, such as low energy prices, have hindered the sector’s development across multiple jurisdictions. Europe appears to be an exception, with increasing deal flow and availability of opportunities, driven by the EU’s increasingly favorable regulations.

In Latin America, the growth trend that peaked in 2022 has reversed in 2023-2024. By 2025, renewable energy adoption in Latin America and the Caribbean is expected to grow 3 to 5 percentage points less than originally projected. The decline is attributed to global uncertainties, regulatory shifts, and grid instability in countries like Ecuador and Guatemala.

Meanwhile, upstream activity in the region reached USD 8.3bn by Q324, marking a significant 48% increase compared to the total for 2023 (excluding Chevron’s USD 42.6bn acquisition of Hess). This surge was driven by the aggressive expansion of E&P companies, which accounted for 52% of total transaction volume this year.

February started with major deals in the sector:

Ecopetrol completed the acquisition of Repsol’s 45% stake in the CPO-09 block for USDm 452, becoming the sole owner of this strategic asset in the Piedemonte Llanero region. The transaction was approved by Colombia’s Superintendence of Industry and Commerce and included an amendment to the exploration and production contract with the National Hydrocarbons Agency.

Brava Energia sold 11 onshore fields in the Potiguar Basin to Azevedo & Travassos Petróleo and Petro-Victory Energy (PVE) for USDm 15. The deal includes an initial payment of USD 600,000, with the remaining balance due over eight years, pending approval from Brazil’s National Petroleum Agency (ANP).

Perfin Infra acquired 50% of VirtuGNL for BRLm 450 through a convertible debenture, with an initial investment of BRLm 100 and the remainder tied to performance targets. The funding will support the expansion of LNG truck fleets and the development of decarbonization.

Renewable energy investment: a matter of leadership and strategic interest

This does not mean the region lacks potential for renewables—rather, executive leadership and strategic interest will play a crucial role in shaping the transition. The latest CEO Outlook by PwC positioned Latin America as a key hub for renewable energy investment, with its abundant solar and wind resources attracting global capital. Growing interest in lithium and other critical minerals is also expected to drive M&A activity in the mining sector, particularly in Chile and Peru.

In Colombia, renewable energy capacity is set to grow by 35% in 2025, with 19 new projects adding 2,550 MW to the grid, according to SER Colombia. This expansion will contribute 12% of the country’s electricity generation, with investments totaling COP 3.7 trillion and the creation of 6,000 jobs. The Cundinamarca and Tolima regions are leading this growth.

Renewables also starred billion-dollar transactions in february:

Cargill exercised its right of first refusal and acquired the remaining 50% stake in SJC Bioenergia, becoming its sole owner. The BRL 2.6bn deal includes debt assumption and is subject to CADE’s approval. The acquisition reinforces Cargill’s renewable energy strategy amid the rising valuation of Brazil’s sugar-energy sector.

Hydro Rein acquired a 20% stake in the Vista Alegre solar complex in Minas Gerais, with a 902 MWp capacity and an annual generation of 2 TWh. Atlas Renewable Energy remains the majority shareholder. The transaction includes a 21-year power purchase agreement with Albras.

While uncertainties persist, the region remains strategically positioned for renewable energy investment—if the right financial and regulatory conditions align.

This newsletter is brought to you by Ideals. Get in touch to share a deal or market rumors: pelayo.mateache@idealscorp.com

Here are some quick updates to keep you in the know:

General Landscape

Brazil

The Brazilian wind sector seeks stability to attract long-term investment

Safra sees the risk of Eneva “losing steam” in the short term

Fuel for the Future boosts investments of BRL 7 bn in crushing plants

Raízen: Geovane Consul, ex-BP, takes over as VP of ethanol, sugar and bioenergy

Storage will allow further expansion of renewable energies in Brazil, says Aneel director

RZK inaugurates 6.3 MWp solar plant and plans six more in Piauí

Solar and wind capacity grows by 20%, but progress slower in rich countries

Mergers and acquisitions in electricity totaled 72 operations in 2024

Brazil's photovoltaic market faces challenges, but opens up space for innovative solutions

Intersolar Summit Northeast highlights the region's strategic role in the electricity sector

Sources claim that NBR 17193 was published without the consensus of the standard's committee

Brazil intensifies electricity exports to Argentina and Uruguay

Number of mergers and acquisitions in the electricity sector is the highest in 20 years

EPE presents studies on the energy transition scenario in Brazil

Brazil is one of the four countries with the most potential in green industry, says report

We want to generate energy on a large scale with floating solar, says Itaipu director

Azul creates business unit to sell carbon credits to companies

Eletrobras and Antaq sign partnership to decarbonize port operations

Chamber and Senate move forward to take care of electricity sector projects

Ceará Government signs contract with EDP in migration to the free market

Aneel extends deadline for government to resolve deficit in Itaipu account

Hydrogen thermoelectric plants and the reliability of the electrical system

Eneva plans expansion of gas liquefaction plant in the Parnaíba Complex

Fachin suspends process over Subida da Serra gas pipeline for another 30 days

Total hydroelectric plants authorized to participate in power auction exceeds 5 GW

Equinor reduces investments in renewables and intensifies oil and gas production

Tax reform will require review of contracts and training of teams in the energy sector

Oil companies and energy companies signal retreat in renewable targets

Commission debates creation of the Low Carbon Hydrogen Development Program

Eletronuclear announces cost cutting package on the eve of discussion on Angra 3

Petrobras sells biodiesel bunker in Singapore for the first time

After being acquired by Vibra, Comerc wants to expand its reach in the free energy market

BNDES and RS government sign agreement for climate resilience plan

E30 can reduce Brazil's dependence on imported gasoline, assesses MME

Advancement of the energy transition faces regulatory challenges

Brazil emerges as a destination for green investments, after a shift in the USA

LATAM

Peru will award four electrical projects for EURm 162.7 in February

The Government of Peru affirms that nuclear energy is a great opportunity for the energy transition

Distributed generation in Argentina increases by 92% in 2024, and reaches 58.9 MW

Vaca Muerta started the first month of 2025 with a new record

Genneia advances with the mining line to supply lithium with renewable energy in Salta

2% of energy generation in the region is nuclear, according to Olade

Petroecuador plans to receive USDm 128 from Petrochina for the sale of crude oil

Argentina ended 2024 with more than 900 MW of new installed renewable capacity

85% of the renewable capacity declared under construction in Chile is photovoltaic

The new brake on the adoption of renewable energies in Latin America and the Caribbean

350renewables identifies more opportunities in demand management and growth of private PPAs in Chile

Colombia's energy sector requires timely and efficient decisions

Brazil and Uruguay sign agreement to expand electricity exchange

Mexico

Discover our other publications

If you want to stay updated on global M&A/PE news, you can also subscribe to the M&A Community Latam, M&A Community Brasil, M&A Teaser Italy, and M&A Teaser Iberia, in addition to our Energy Deals Newsbreak Iberia with the most relevant information on the energy sector in Iberia.